With the housing marking being hot for so long and interest rates on the rise, do you think real estate is still a smart investment?

Do you think that home ownership can still benefit you in the long run?

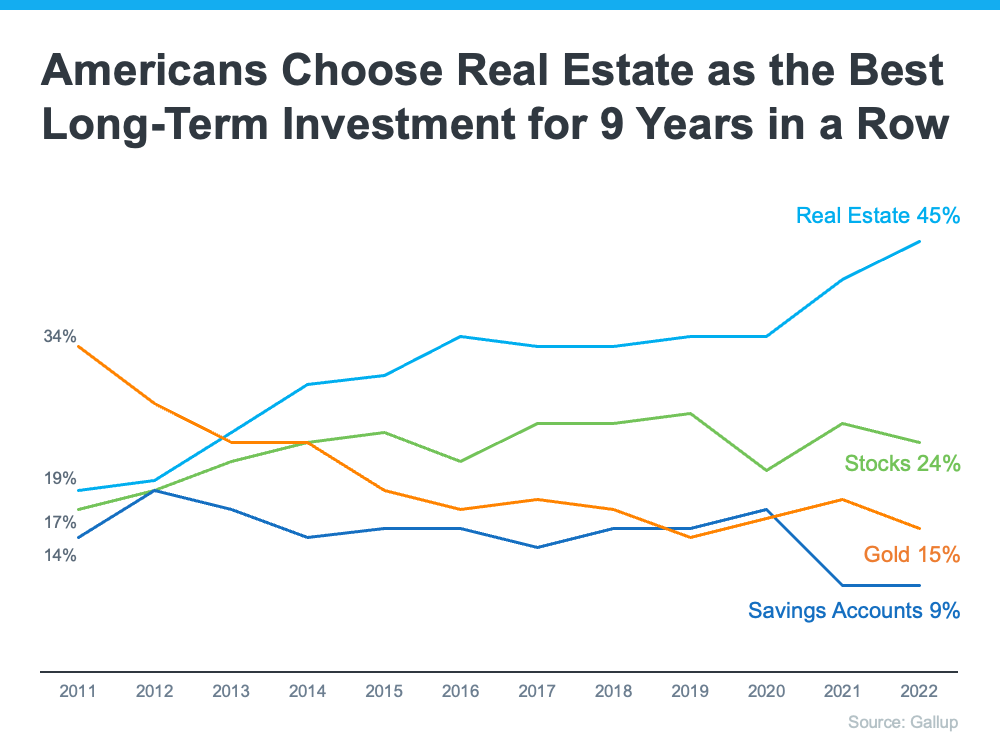

If your answer is yes, you’re in good company. In their most recent annual survey, Gallup found that Americans view real estate as an excellent investment. Not only was real estate chosen as the best investment for the ninth year in a row, but more Americans selected it than ever before.

The graph below shows the results of the survey since Gallup began asking the question in 2011. As the trend lines indicate, real estate has been gaining ground as the clear favorite for almost a decade now.

Here are the main reasons why we believe real estate is a good investment in 2022.

Reason 1: Real estate increases wealth steadily.

Mark Cussen of Investopedia puts it like this: “There are many advantages to investing in real estate… It often acts as a good inflation hedge since there will always be a demand for homes, regardless of the economic climate, and because as inflation rises, so do property values…”

Home prices will continue to rise in 2022. As the value of your home increases, so will your equity and therefore your net worth.

Of course, these are general statements and you need to take a hard look at the specific attributes of your home or the home you want to buy. If the home has not been properly maintained or can’t be repaired because of the financial commitment required, that home may not appreciate at the same rate as others in the neighborhood.

Reason 2: Real estate shields you from inflation.

Inflation recently hit a 40-year high. You’ve probably noticed the effects everywhere, including at the gas pump, at the grocery store, and at the hardware store.

When you invest in a home, you lock in a monthly payment (principal and interest) for many years, thereby eliminating the effects of future inflation on your basic home payment (not including taxes and insurance, which can change). Since housing is usually the single largest budget item for most people, this is an excellent way to shield yourself from inflation.

Where homeowners do have to think about inflation is when significant repairs or upgrades are required. The costs of building materials rise with inflation and everything from roofing to flooring will cost you more.

Renters don’t have the same protection, so avoiding inflation can be a motivator for some buyers. As Danielle Hale, Chief Economist at realtor.com, notes: “Rising rents, which continue to climb at double-digit pace… and the prospect of locking in a monthly housing cost in a market with widespread inflation are motivating today’s first-time homebuyers.”

Reason 3: Real estate is nearly foolproof.

Real estate is a very low-risk investment when you’re buying a home to live in.

“The only people who lose money in real estate are those who bought at the height of the market and sold at the wrong time or took too much equity out of their home, leaving no profit margin when they sold it. It often takes time to see big appreciations, but if you hold on to your investment, you will,” said Dottie Herman, CEO of real estate brokerage Douglas Elliman. If you’re planning to live in your new home for a few years, you should see your investment grow in value substantially.

We would add to Ms. Herman’s statement that owning a home that has not been maintained or updated in decades could also be on the losing end of a real estate transaction. Over spending on repairs that won’t return their investment could take money out of the owner’s pockets.

Bottom Line:

Buying and owning a home is a powerful decision. It’s no wonder why so many people view it as the best long-term investment, even when inflation is high. When you buy, you help shield yourself from increases in your housing costs and you own an asset that typically gains value over time with very little risk.

Work with MarketPro:

None of today’s information should be considered investment advice. This is our take on recent data and being a leading homebuyer. What we can say with all certainty is that if you’re investing in a new home and want to sell your current home, we’d love to help you at MarketPro Homebuyers.

We’ll give you a fast cash offer for your current home just as it is now; no repairs, no inspection, no commissions or fees. You can even choose your exact closing date to coordinate perfectly with the purchase of your new home. Our team will walk you through your quote, including a review of what your home would likely bring on the open market. Sell your home the easy way so you can be ready to invest in a new home!

If you’re in Washington, D.C., Maryland, Virginia, Pennsylvania, or Florida , we’d love to show you how easy and stress-free the sales process can be. Contact us today for a same-day, no-pressure quote.