If you dream of owning a home or upgrading from your current home, you may be watching home prices with some worry. Why do prices keep going up? If you buy now, will your investment hold value or will prices start to drop? Trying to navigate this market can bring all sorts of emotions!

Data shows that home prices are continuing to rise, and this movement is expected to continue. Let’s take a closer look at the details, and what this means for you as a buyer or seller.

Understanding 2023 home price changes:

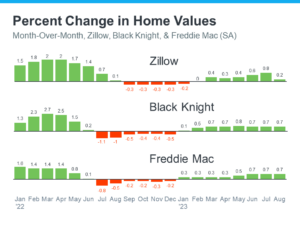

National data from Freddie Mac, Zillow, and Black Knight shows that home prices have been going up consistently this year (see graph below).

As you can see, home prices rose dramatically in the first half of 2022. These changes were unsustainable, so prices corrected during the second half of the year and started dipping a bit. Those declines were slight and short-lived, but they were highly publicized in the media, so it brought worry and uncertainty.

So far in 2023, prices have been rising again, as you can see on the graph—but at a more normal, sustainable pace. This is great news for the housing market; slow and stable price appreciation is the goal. We are back to normal in this aspect, and we have no reason to believe that prices will drop.

Orphe Divounguy, Senior Economist at Zillow, explains: “The U.S. housing market has surged over the past year after a temporary hiccup from July 2022–January 2023… That downturn has proven to be short-lived, as housing has rebounded impressively so far in 2023.”

We may see home price appreciation slow as the year comes to a close. It’s important to understand that the slowing of appreciation (also known as deceleration) is completely different from depreciation, where homes actually lose value. Deceleration means that your home is gaining value more slowly, but it’s still gaining value. It’s normal to see some deceleration at the end of the year, and it’s nothing to worry about.

Why do home prices keep increasing?

Right now, we still have limited inventory. Demand is still higher than supply, as many people are unwilling to list their homes when rates are high.

Freddie Mac explains: “While rising interest rates have reduced affordability—and therefore demand—they have also reduced supply through the mortgage rate lock-in effect. Overall, it appears the reduction in supply has outweighed the decrease in demand, thus house prices have started to increase.”

Here’s what this means for you:

As a buyer: If you’ve been waiting to buy because you were worried that home prices might go down, making your home lose value, seeing these trends should make you feel more secure in your investment. If you’re worried about affordability, you should know that smaller and more affordable homes are on the rise.

As a seller, know that you likely gained record amounts of equity in recent years, even if your home is dated or in need of repairs! Now is a great time to use your equity to buy your dream home or achieve other important goals. You can make the most of your equity by getting cash for your home from MarketPro Homebuyers.

Don’t worry if your house is less than perfect; we buy houses in any condition. We buy houses if they need new roofs, new appliances, a massive update, extensive plumbing work—or all of the above! Throughout it all, we provide an exceptional customer experience.

Work with MarketPro:

We’ll give you a fast cash offer for your current home just as it is now; no repairs, no upgrades, no inspection, no commissions or fees. We buy houses on your schedule; you can even choose your exact closing date. Our team will walk you through your quote, including a review of what your home would likely bring on the open market.

If you’re in Washington, D.C., Maryland, Virginia, Pennsylvania or Florida, we’d love to show you how easy and stress-free the sales process can be. Contact us today for a same-day, no-pressure quote.