There has been a lot of talk about a recession lately; 70% of Americans think a recession is coming. Is a recession really on its way—and if so, what does this mean for real estate? If you’re in the market for your dream home, should you still sell your house fast and go ahead with your plans to upgrade? Let’s first take a look at what experts are saying.

Are we going into a recession?

There’s no unified expert opinion on this issue; some experts say a recession is imminent, while others say the economy is slowing but still strong. Jeffrey Roach, chief economist for LPL Financial, says that “a slowdown has to be significant, broad and sustained before it qualifies as a recession,” and that “Currently, the economy is downshifting to a much slower growth path, but the decline in economic activity is not ‘significant’ in our view.”

According to Tomas Philipson, a professor of public policy studies at the University of Chicago and former acting chair of the White House Council of Economic Advisers, whether or not we’re in a recession is a matter of semantics at this point; “What really matters is paychecks aren’t reaching as far. . . What you call it is less relevant.”

It’s clear that the economy is slowing to some extent. Let’s look at how real estate might be affected if this slowdown is a recession.

How has real estate historically been affected in a recession?

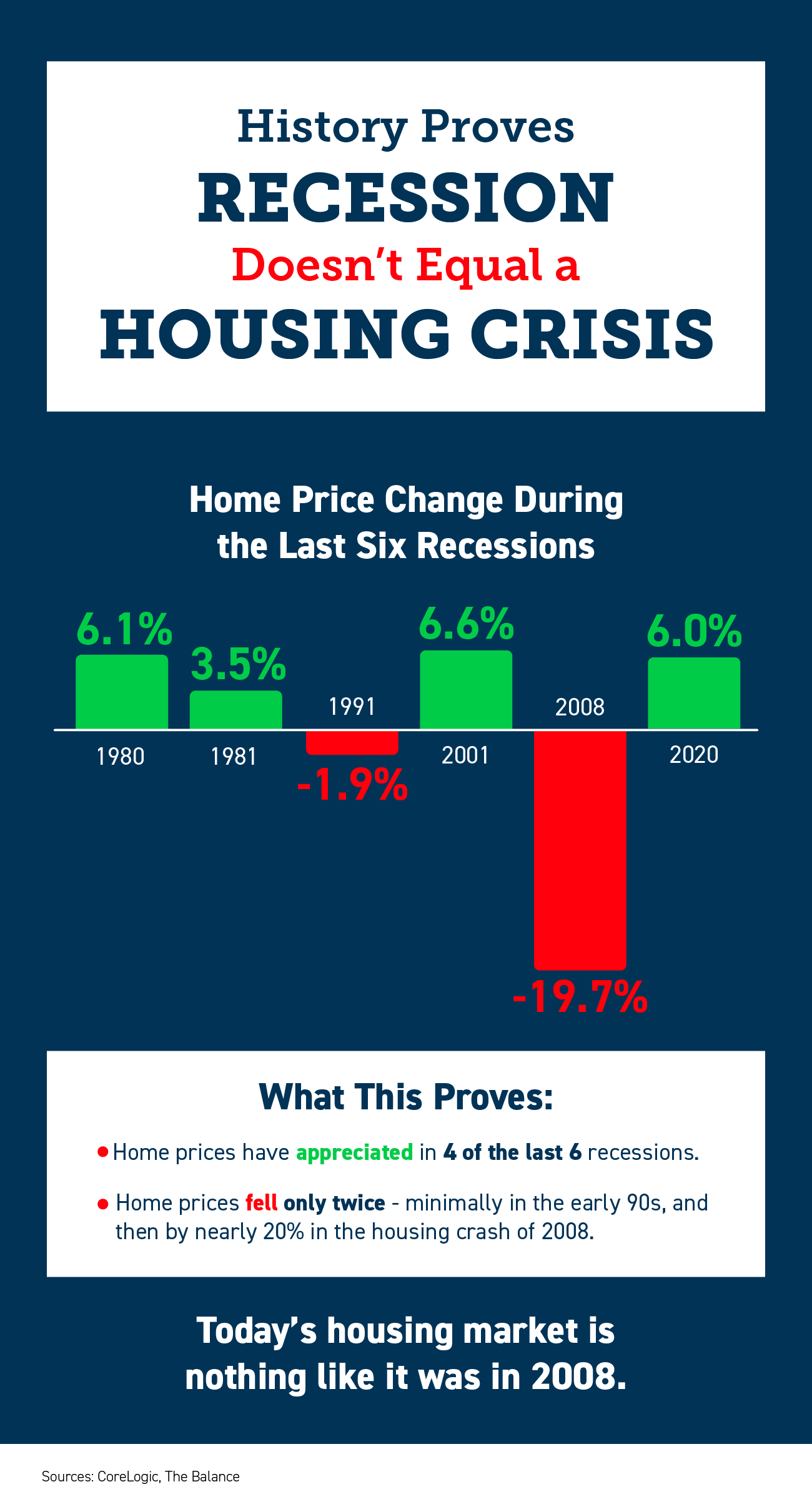

History shows us that a recession does not equal a housing crisis.

As you can see from the above graph, home prices have actually appreciated during four of the last six recessions. Furthermore, only one of the two drops was significant—this was the housing crash of 2008. This information tells us that we need to look at our specific circumstances today, rather than assume a recession will bring a housing crash.

What can we expect if a recession happens today?

Today’s housing market is nothing like 2008. In 2008, many purchasers were not truly qualified for the mortgage they obtained, which led to more homes turning into foreclosures. Lending standards are much stricter now, and homeowners have much more equity than they did in 2008, putting them in a much stronger financial position. Our housing market is strong, rather than a bubble waiting to pop like in 2008.

If a recession does happen, we can expect real estate to retain its value. Experts are predicting that appreciation will slow, but values will hold.

What does this mean for potential homebuyers?

Even if we are headed into a recession, real estate remains a strong investment. If you sell your house fast and get into your dream home in 2022, you’ll also maximize how you can use home price appreciation to your benefit. Owning real estate also shields you from inflation. If you’re planning to sell your current home and buy your dream home, there’s no reason to change your plans.

Work with MarketPro:

If you’re ready to sell your house fast but it needs some work, we’d love to help at MarketPro Homebuyers.

We’ll give you a fast cash offer for your current home just as it is now; no repairs, no inspection, no commissions or fees. You can even choose your exact closing date to coordinate perfectly with the purchase of your new home. Our team will walk you through your quote, including a review of what your home would likely bring on the open market.

If you’re in Washington, D.C., Maryland, Virginia, Pennsylvania, or Florida , we’d love to show you how easy and stress-free the sales process can be. Contact us today for a same-day, no-pressure quote.