The 2023 real estate market has been quite a rollercoaster, with mortgage interest rates and inflation taking center stage. If you’ve been eyeing the housing market this year, you’ve likely been on the edge of your seat as the Federal Reserve grappled with inflation, and mortgage rates reached unprecedented highs. Unfortunately, these soaring rates led to decreased affordability, a shortage of available homes, and a dip in sales.

As we bid farewell to 2023, there’s a silver lining – mortgage rates have started to inch their way down. So, what’s in store for 2024? Let’s dive into the crystal ball and see what the latest news and history has to say about what might await us.

What’s next for mortgage rates?

As inflation has slowed, the Fed has been able to slow and sometimes pause their rate hikes. This has eased the upward pressure on mortgage rates, and we have even seen some downward movement in mortgage rates recently. Rates are still somewhat volatile, and we’ll probably see some ups and downs in 2024. However, most experts do agree that rates will trend downward in 2024.

“It’s important to note that significant drops in mortgage rates might not happen in the early months of 2024,” notes Bank of America head of retail lending Matt Vernon. “If any reductions occur, they are likely to be gradual, possibly beginning in the latter part of the year.”

What’s next for housing sales?

When we see mortgage rates trending downward, we expect to see housing sales go up. “Retreating mortgage rates will bring more buyers and sellers to the market and get Americans moving again,” explains NAR chief economist Lawrence Yun. More buyers are able to afford a home when rates are lower, and more sellers are willing to give up their current low-interest-rate mortgages.

Selma Hepp, chief economist at CoreLogic, elaborates: “Lower mortgage rates would help spur home sales activity, which are expected to increase in 2024 compared to 2023. Declines in mortgage rates will drive more sellers to trade their existing home and help add much-needed inventory to the market, leading to more transactions.”

All of this is movement towards a more normal, stable housing market.

What’s next for home prices?

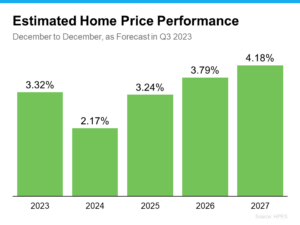

There was concern home prices would crash this year, but that didn’t happen. Instead, home prices have continued to rise—just at a more sustainable rate as compared to the last couple of years. Take a look at data from the Home Price Expectation Survey from Pulsenomics, which collects opinions from a national panel of over 100 experts in economics, real estate, and investing. As the graph below shows, experts believe that appreciation will continue next year and in the years to come.

What this means for you:

If you’re planning to buy a house in 2024, you should know that buying a home is still a solid investment. With rates falling, you should see affordability increase somewhat. You’ll likely have more homes to choose from in 2024 as compared to 2023.

If you’re planning to sell a house in 2024, know that it’s still predicted to be a seller’s market. “Given expectations about interest rates and supply, demand will probably exceed supply similar to current conditions,” Chen Zhao, senior manager of economics at Redfin explains. “Supply is likely to remain below what we would deem a balanced market.” It will be a good year to sell!

However, this doesn’t necessarily apply to distressed houses; as long as rates are still high, most buyers will want to purchase a home that’s move-in ready. Interest payments are eating up any renovation budgets that may typically be a factor. Luckily, there’s a reliable option for selling a distressed home anytime, no matter what’s going on in the real estate market. At MarketPro Homebuyers, we’ll give you a fast cash offer for your distressed home as-is. We move on your timeline, and we’re always ready to buy.

Work with MarketPro:

We’ll give you a fast cash offer for your current home just as it is now; no repairs, no upgrades, no inspection, no commissions or fees. You can even choose your exact closing date. Our team will walk you through your quote, including a review of what your home would likely bring on the open market.

If you’re in Washington, D.C., Maryland, Virginia, Pennsylvania or Florida, we’d love to show you how easy and stress-free the sales process can be. Contact us today for a same-day, no-pressure quote.