The headlines surrounding the real estate market are starting to get out of control. Rates are higher and the market is not the same as it was a year ago. But what does that actually mean for homeowners?

Let’s take a look at the numbers and we’ll share our insights about what’s happening now and what it means for the rest of 2023.

According to a new NerdWallet survey, “two-thirds (67%) of Americans say a housing market crash is imminent in the next three years.” With the news focusing on increasing inflation and rising mortgage rates, these fears are understandable. If you’re thinking of selling your distressed home to buy your dream home, you may share these fears. You might even be worried about a major crash like the crash of 2008.

We’re happy to tell you that it’s highly unlikely we’ll have a serious housing market crash like the crash in 2008. Here’s why this year is much different from 2008, and what we expect to see happen in Q2 and beyond:

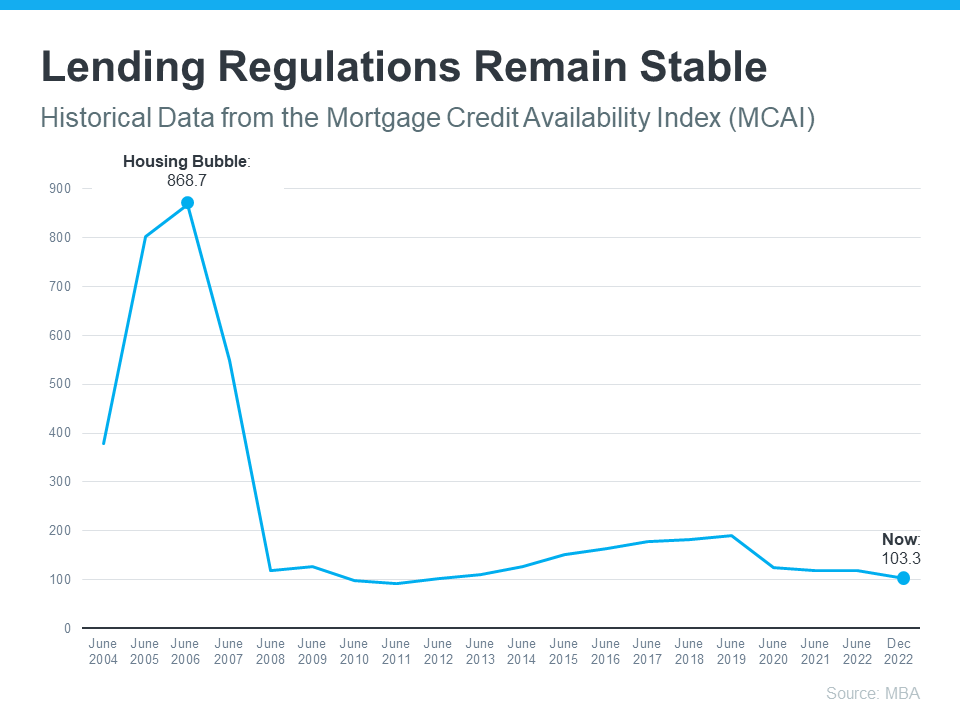

Difference 1: Mortgage standards are stricter now.

Prior to the crash of 2008, we had overly lenient lending standards. Banks made it much too easy to qualify for a mortgage, and people were approved for mortgages that they couldn’t truly afford. This was risky for both banks and for individuals, and the situation led to high levels of defaults and foreclosures.

Data from the Mortgage Bankers Association (MBA) illustrates this difference:

It’s clear that increased lending regulations have created a more stable situation. We do not have an artificial housing bubble waiting to burst like we had prior to 2008.

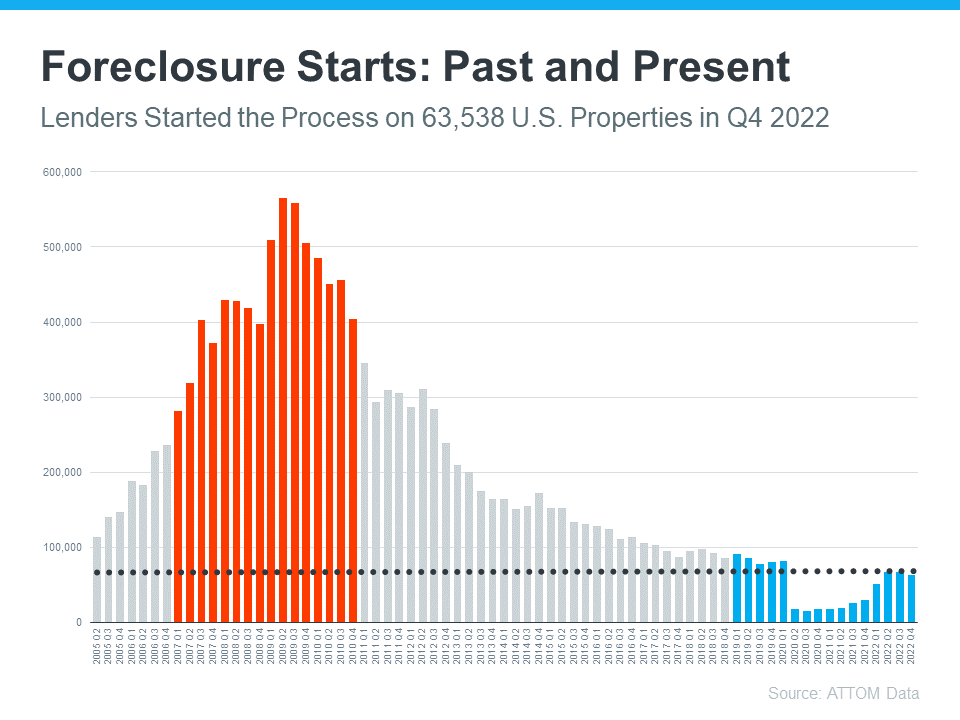

Difference 2: Foreclosure levels are nothing like 2008.

While foreclosures are higher than 2022 due to the ending of pandemic-related foreclosure moratoriums, foreclosure activity is still below pre-pandemic levels. We may see some increase of foreclosure activity this year, but it won’t be anything like 2008. This graph illustrates the difference:

Again, this is change is due to tighter lending standards. Buyers are typically well-qualified and less likely to default on their mortgages.

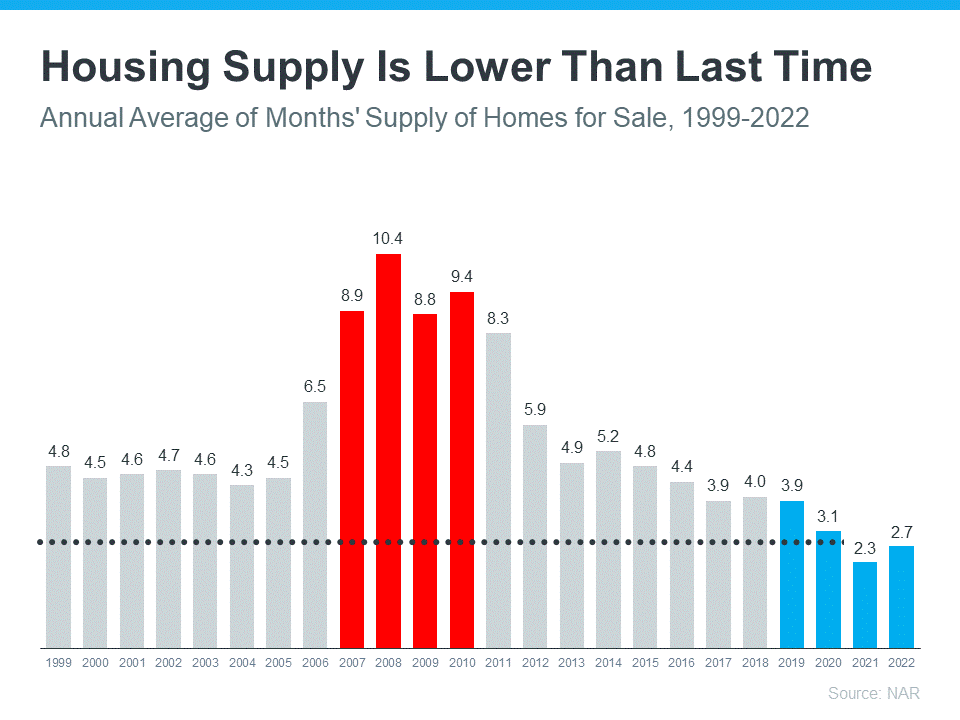

Difference 3: Inventory is much lower than 2008.

The dramatic foreclosure activity in the 2008 crash caused an extreme oversupply of inventory, which caused home prices to plummet. Bill McBride, Founder of Calculated Risk, explains how our current situation is different: “The bottom line is there will be an increase in foreclosures over the next year (from record level lows), but there will not be a huge wave of distressed sales as happened following the housing bubble. The distressed sales during the housing bust led to cascading price declines, and that will not happen this time.”

The numbers back this up. Data from the National Association of Realtors (NAR) tells us that current unsold inventory for existing home sales sits at 2.7 months’ supply, which is quite low. Even if foreclosures increase this year, we expect supply to stay lower than demand. This means we do not expect to see home prices crash. To illustrate this point, here’s a graph of how our current supply compares to the supply around the time of the crash:

Bottom line:

Our current market environment is nothing like the situation surrounding the crash of 2008. While we expect some market changes in Q2 and beyond, we do not expect anything extreme. The market has shown signs of stabilizing, and you can buy and sell without fear of a major crash.

What does this mean for you?

If you’re thinking of selling your current home to buy your dream home, don’t be worried. You can expect strong real estate values to continue, especially in areas like Washington, D.C., Maryland, Virginia, Pennsylvania and Florida.

Work with MarketPro:

We’ll give you a fast cash offer for your current home just as it is now; no repairs, no upgrades, no inspection, no commissions or fees. You can even choose your exact closing date. Our team will walk you through your quote, including a review of what your home would likely bring on the open market.

If you’re in Washington, D.C., Maryland, Virginia, Pennsylvania or Florida, we’d love to show you how easy and stress-free the sales process can be. Contact us today for a same-day, no-pressure quote.