While we are seeing some minor fluctuations, mortgage rates are generally trending in a downward direction. If you’re thinking of selling your home, you may be wondering whether it’s the right time to sell. Are we about to see a big influx of listings?

To help answer these questions, let’s look at what’s been happening with the “mortgage rate lock-in effect,” what’s changing as rates move lower, and what this means for you as a buyer or seller.

The mortgage rate lock-in effect:

The mortgage rate lock-in effect refers to homeowners not wanting to exchange their low-interest-rate mortgage for a new, higher-rate mortgage. People may stay longer in a home that no longer fits their needs just because they don’t want to give up their lower interest rate. This has been causing low inventory in the housing market. As an article from Freddie Mac tells us:

“The lack of housing supply was partly driven by the rate lock-in effect… With higher rates, the incentive for existing homeowners to list their property and move to a new house has greatly diminished, leaving them rate locked.”

What’s changing:

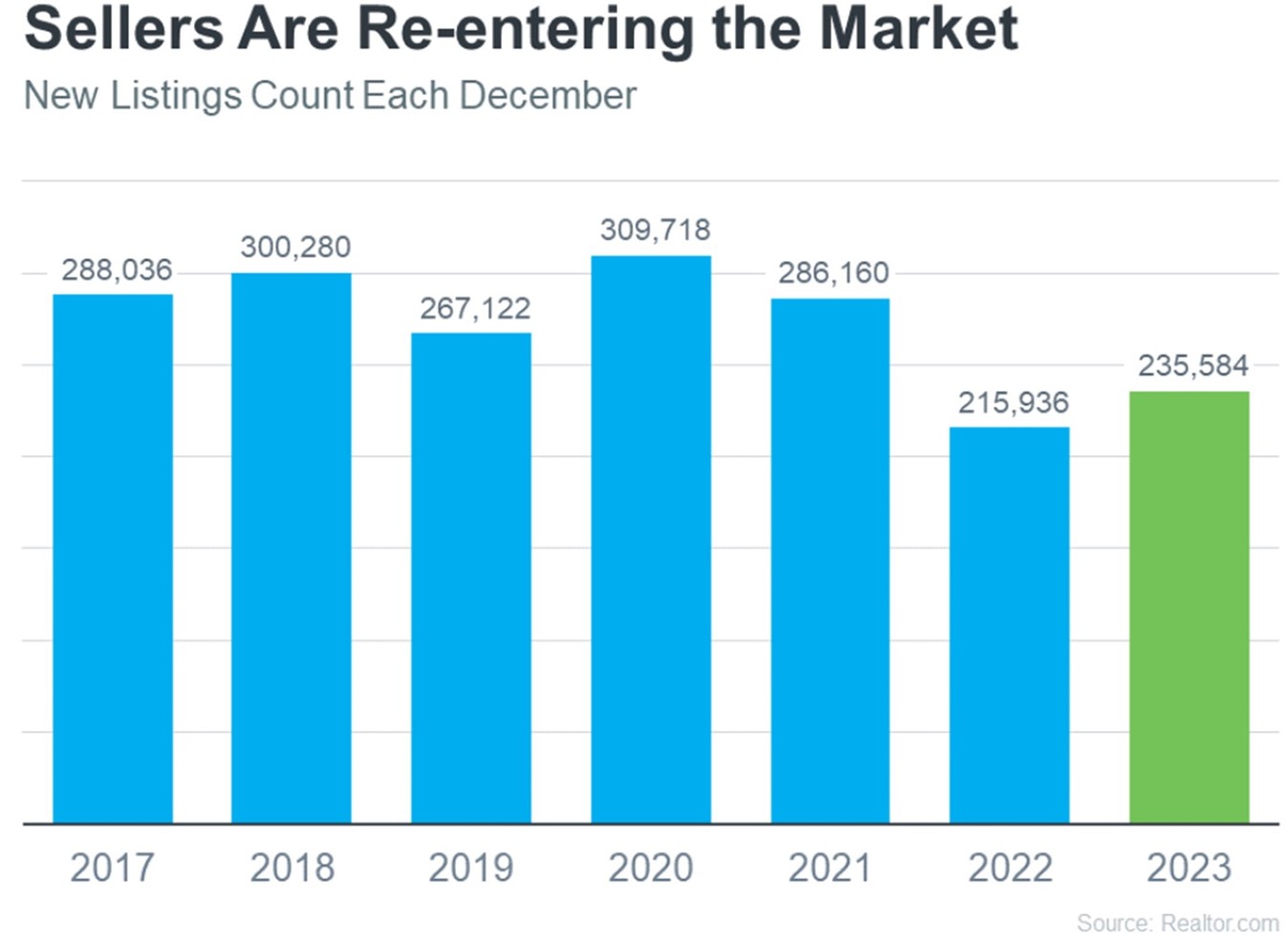

Homeowners are now showing signs of being ready to move. Data from Realtor.com tells us that new listings increased in December 2023 compared to December 2022 (see graph below):

This appears to be an easing of the mortgage rate lock-in effect, thanks to lowering rates. A recent article from the Joint Center for Housing Studies (JCHS) explains:

“A reduction in interest rates could alleviate the lock-in effect and help lift homeowner mobility. Indeed, interest rates have recently declined, falling by a full percentage point from October to November 2023… Further decreases would reduce the barrier to moving and give homeowners looking to sell a newfound sense of urgency.”

As rates gradually fall lower throughout the year, we expect to see even more houses come onto the market. This will likely be a slow increase, not a sudden change.

What this means for you:

So, what does this mean for you as a buyer or seller?

As a buyer: If you’ve been searching for your next home with no success, don’t give up; you should have more options to choose from soon.

As a seller: Right now, it’s still a seller’s market. Though we don’t expect to see any sudden changes, we do expect inventory to increase—which means that your competition will increase. If you’re planning to sell this year, now is a great time! This is especially true if your home is distressed; as inventory increases, distressed homes will be even harder to sell.

If you want to sell your house fast, you can work with us at MarketPro Homebuyers. We buy houses for cash, as-is… and when we say “as-is,” we mean it! You may be asking:

“Can I sell my house fast if it needs a kitchen renovation?”

“Can I sell my house fast if it has foundation issues?”

“Can I sell my house fast if it needs a new roof?”

With MarketPro, you absolutely can. You can trust us to help you through the process.

Work with MarketPro:

We’ll give you a fast cash offer for your current home just as it is now; no repairs, no upgrades, no inspection, no commissions or fees. You can even choose your exact closing date. Our team will walk you through your quote, including a review of what your home would likely bring on the open market.

If you’re in Washington, D.C., Maryland, Virginia, Pennsylvania or Florida, we’d love to show you how easy and stress-free the sales process can be. Contact us today for a same-day, no-pressure quote.